Top 10 QuickBooks Tips for Small Businesses

QuickBooks Tips Every Small Business Should Know

QuickBooks is one of the most widely used accounting software platforms among small business owners, and for good reason. It offers robust features to track income, expenses, payroll, and taxes. But many businesses don’t fully utilize what QuickBooks has to offer.

At Accounting Solutions of Boca, Inc, we’ve spent over 15 years helping small businesses in Boca Raton and beyond make the most of their financial software. In this post, we’re sharing our top 10 QuickBooks tips to help streamline your workflow, save time, and ensure your books stay audit-ready.

Why QuickBooks Is Essential for Small Business

QuickBooks gives business owners real-time insights into cash flow, income, expenses, and overall financial health. Whether you’re using QuickBooks Online or Desktop, you can automate bookkeeping, create accurate reports, and prepare for tax season with less stress.

If you’re not sure where to start or want to make sure you’re getting the most from the software, these tips are for you.

10 QuickBooks Tips for Small Businesses

1. Set Up Your Chart of Accounts Correctly from Day One

Your chart of accounts organizes all your financial transactions. Set it up based on your specific business needs so your reports are accurate. Don’t use the default template without reviewing or customizing it.

2. Use Bank Feeds to Automatically Import Transactions

Link your bank and credit card accounts to QuickBooks to save time on manual entry. It ensures accuracy and keeps your books up to date.

3. Reconcile Bank Accounts Monthly

Always reconcile your bank statements with your QuickBooks records. This helps catch errors early and ensures your reports reflect actual financial activity.

4. Create Recurring Transactions for Regular Expenses

If you have rent, utilities, or service subscriptions, set them as recurring transactions. This saves time and reduces the risk of forgetting important entries.

5. Track Mileage and Expenses Using the Mobile App

The QuickBooks mobile app allows you to log expenses and track mileage in real time. It’s especially helpful for business owners on the go.

6. Use Classes and Tags to Categorize Income and Expenses

Classes help you track performance across departments, locations, or projects. Use them to get more detailed insights and improve reporting.

7. Leverage Custom Reports for Smarter Decisions

QuickBooks lets you customize reports like Profit & Loss, Cash Flow, and Balance Sheets. Tailor them to what matters most to your business.

8. Stay on Top of Invoicing and Payments

Use automatic invoicing and payment reminders. This helps maintain steady cash flow and improves collection rates.

9. Back Up Your Data Regularly

For desktop users especially, regular backups are critical. Cloud users get automatic backups, but it’s still wise to export reports regularly.

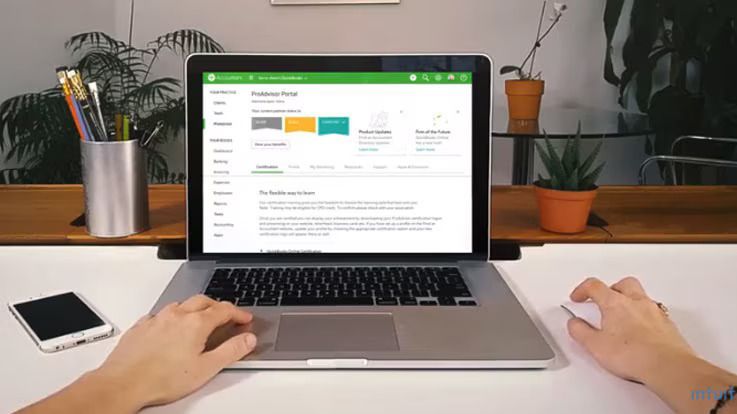

10. Work with a QuickBooks ProAdvisor

A certified expert can help set up, clean up, and optimize your QuickBooks file. They’ll also teach you how to use it more efficiently.

Accounting Solutions of Boca is a QuickBooks specialist and can provide setup, training, and ongoing support tailored to your business.

Common Mistakes to Avoid

- Not reconciling accounts

- Mixing business and personal transactions

- Ignoring payroll liabilities

- Skipping monthly reviews

- Using incorrect tax settings

Avoiding these pitfalls is just as important as applying the tips above.

FAQs

Is QuickBooks Online better than Desktop?

QuickBooks Online is cloud-based, ideal for remote access and automatic updates. Desktop offers more robust features for complex businesses. We help clients choose based on their needs.

How often should I reconcile my accounts?

At least once a month. More frequent reconciliation helps detect discrepancies early.

Can I use QuickBooks for payroll?

Yes. QuickBooks Payroll can automate calculations, direct deposit, and tax filings. We can help with setup and compliance.

What if I made mistakes in my QuickBooks file?

Don’t panic. We offer file cleanups and corrections to get your books back in shape.

How do I get QuickBooks help from your team?

Call us at

(561) 699-1441

or request a consultation through our

Google Business Profile

Work Smarter with QuickBooks Support from Boca’s Experts

If QuickBooks feels overwhelming or underutilized, you’re not alone. Our team at Accounting Solutions of Boca, Inc offers expert QuickBooks setup, training, and cleanup services for small businesses in Boca Raton and across the U.S. Let us help you take control of your books and make smarter financial decisions.

Call now or visit us at 25 Forest Hills Ln, Boca Raton, FL 33431.

We proudly serve local businesses and clients across the United States